3 Simple Options Strategies for High Volatility

If you’ve been following the news over the last few weeks, you’ve probably heard something about volatility. What exactly is volatility? Volatility refers to how much the price of an underlying asset changes over a period of time. When we talk about volatility in the financial markets, we are referring to how much prices for securities (stocks, bonds, currencies) fluctuate up and down during any given day or week. In this article, we will talk about what is volatility? and what are the 3 options strategies for high volatility, one can use to benefits from the high volatility?

Volatility can be good or bad. It all depends on whether it is being used as a risk management tool or if it signals that your investment portfolio may need some work. Here are 3 strategies that have been shown to help manage volatility:

Understanding the Basics of Volatility

Volatility is a measure of the degree to which the price of security varies over time. It is often used in finance and investing as an indication of risk. The amount of change in a security’s price over time can give clues to how it will behave, but it can be difficult to predict.

A security’s volatility can be measured in two ways. The annualized standard deviation represents the average of the squared differences between each day’s closing price and the average for that year. It is used to compare the volatility of a stock with that of other stocks, bonds or indexes. The statistical measure known as beta represents how closely a security follows changes in overall market movements. Beta is used to compare a stock or fund’s volatility with its peers.

Volatility is a measure of risk, but it does not reflect total risk. It does not include other factors such as interest rate changes or corporate actions, such as mergers or acquisitions, that may affect a stock’s price.

High volatility can be an indication of potentially unstable security, but it can also be the result of other factors, such as a lack of information available to investors. Volatility is not necessarily a sign that a security will decline in price. It is only one factor that investors should consider when deciding whether to buy, hold or sell a security.

The volatility of a security can be measured using its historical volatility, implied volatility, or realized volatility. Historical volatility is the standard deviation of the security’s price over a specific period of time. Implied volatility is what options traders use when they are pricing option premiums. Realized volatility is based on the actual closing price and represents what a stock’s actual price movement has been over a period of time.

There are several ways to measure historical and implied volatilities. The most common method uses daily closing prices for a security, but some investors may use intraday prices to get a better picture of short-term price fluctuations. Traders can also look at the volatility of a security using weekly, monthly or annual prices.

Investors should look at the historical volatility of a security to understand how much it has fluctuated in the past. The higher the historical volatility, the more likely a security is to experience large price swings in the future.

Traders can also calculate implied volatility from option prices using an options pricing model. When there is a high level of implied volatility in an option price, it means that there is uncertainty about whether the option will expire in-the-money or out-of-the-money.

Implied volatility is used by traders to gauge the risk associated with an investment. This measurement can be useful in evaluating stocks that are volatile and those that are relatively stable. It also helps traders determine whether an option’s price is currently overvalued or undervalued. Means: high the Implied volatility, higher the option premium.

Using Volatility as a Risk Management Tool

Volatility can be a risk management tool if you use it properly. If you have a portfolio of investments with the goal of reducing volatility, you might consider hedging your portfolio by taking out a put option on some or all of your stocks. This will help to reduce the risk of fluctuations in stock prices on the market.

The downside of this is that you will have to pay a premium for the put option. This means that your investment will not return as much money as it would otherwise.

If you want to reduce volatility in your portfolio, but don’t want to lose money in the process, you might consider an inverse ETF. These are funds that track the opposite of the index. For example, if the index is up 10 percent for the year, then an inverse ETF might be down 10 percent for the year.

This means that when a market index goes up, your investment goes down and vice versa. The upside of this is that they tend to be less expensive than put options and they also tend to come with less risk attached because they are tied to indexes rather than individual stocks.

Another way that volatility can be used as a risk management tool is through diversification. Diversification ensures that an investor is not overinvested in any one particular company, industry, or sector. This will help to reduce investment risk by spreading it among various types of securities, such as stocks, bonds, and mutual funds.

One way or another, volatility can be used as a risk management tool if you know how to use it correctly. You just have to decide which method will work best for you and your portfolio based

One last risk management strategy would be to use volatility as a buying opportunity. For example, if you are interested in purchasing stock in Company A but you are concerned about the price going down before you buy it, then you could purchase an options contract for Company A’s stock instead. The contract would give you the right to purchase Company A’s stock at a predetermined price during a certain period of time. You may choose this method if you want to invest in Company A but don’t want to take the chance that its share price will fall before your purchase date arrives.

3 Options Strategies for High Volatility

As you have shared that high volatility means high option premium. So when option premiums are high, what will you do? Will buy option or sell option?

Obviously, you will sell options. So if you want to benefit from high volatility you should choose strategies where you will receive the net credit. I prefer these 3 options strategies for high volatility:

1 – Credit Spreads Option Strategies

A credit Spread involves the selling, or writing, a high premium option and simultaneously buying a lower premium option. The premium that is received from the written option will be greater than the premium paid for the long options, resulting in the premium credited into the trader or investor’s account when the position is opened.

When the traders or you can say the investors use the credit spread strategy, then the maximum profit they receive is the net premium. The credit spread results in a profit when the options spread narrow.

Example: Trader A implements a credit spread strategy by selling a call option with the strike price of 30 for ₹3 and simultaneously buying call options with 40 and ₹1. Therefore, the lot size of the underline script is 100. So the net premium received will be ₹200 for the trade. Furthermore, the trader will profit if the spread strategy narrows.

The pay-off chart looks like this:

I have written a detailed article on spread option strategies. You can check here: Best Guide to Learn Option Spread Strategies for [FREE]

or

You can download my free Pdf: How to create a high probability credit spread strategy in 5 Easy Steps

2- Iron Condor Option Strategy

Iron Condor strategy is a range-bound strategy and works well in a sideways movement. But how we will know that this particular stock will remain range-bound. For this, I’m following some simple techniques.

Iron condor strategy is a credit spread option strategy to trade for a range-bound activity in the market. It’s a leg strategy and the formation is:

- Sell OTM Call & OTM Put

- Buy further OTM Call & Further OTM PUT (to limit your risk)

The pay-off chart looks like this:

It’s a limited Risk & Limited reward strategy. The beauty of this strategy is, You know before entre in any trade how much maximum you can lose or how much is the maximum profit from this strategy.

And if you think that risk is high or return is low, you can optimize it in such a way that it can fit in your risk management rules.

I have written a detailed article here: Iron Condor strategy – A Simple yet effectual approach for a Range-bound stock

In the above article, I have shared what rules I’m following to optimize my strategies along with the adjustments.

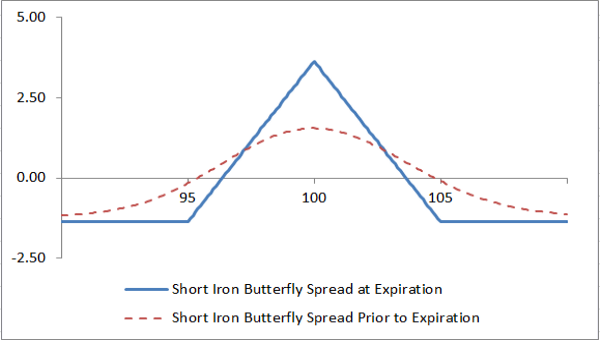

3- Iron Butterfly Option Strategy

This strategy is similar to the Iron Condor options strategy. The only difference is we are selling at the money option strikes (ATM) instead of Out of the money (OTM) strike.

This risk is very less in this strategy compared to the Iron condor option strategy but the probability is also very low. You can use this strategy when expiry is near or you are expecting the script to expire in a very narrow range.

The pay-off chart looks like this:

Conclusion

Now that you know what volatility means, and how it can affect your trading activity, these three strategies may help manage volatility.

In case you have any queries related to these 3 options strategies for high volatility, feel free to comment below.

And if you want to learn these options strategies for high volatility and many other option strategies with adjustments then you must check the mentorship program.

Options Strategies – A Mentorship Program

Learn About Trading Options in a course led by an Industry Expert. It doesn’t matter how old you are, the mentorship program is open to everyone who wants to learn more about the various option trading strategies. You’ll learn everything you need to know about these strategies and more. Don’t wait, Enroll today!