Weekly Analysis & Option Trading Plan for November 02, Expiry

Get the latest weekly analysis and option trading plan for the November 02 expiry, including expert insights, key levels to watch, and recommended strategies.

Hey Folks! I hope you are safe and healthy in this Market crash. In today’s article, Lets discuss what had happened in the current week and what should be the the trading plan for coming week i.e. October 30 to November 03, 2023.

I’m sharing three tips for money management in Options Trading along with Weekly Nifty and Bank Nifty options trading strategies for the November 02,2023 expiry. So read this post till the end to know the trend and the levels you should track for the coming week.

Money Management in Options Trading

In stock trading, money management plays an important role. Good money management will not only help you make good money, but it will also help you manage your risk. In today’s post, I’m sharing 3 tips you should follow to manage your money in options trading. These 3 tips are:

- You should play only with dedicated trading capital.

- Never risk all of your trading capital at one trade

- Trade with a proper trading plan.

These are the three tips you should follow to manage your money in options trading. Let us look into these tips a little more deeply.

1. You should play only with dedicated trading capital.

Options trading is the riskier game. So, never trading trade with your savings, loans, or any capital that you can’t afford to lose. It will help keep your trading free from emotions. Because emotions are the biggest enemy of successful trading.

It will assist you in making sound decisions during a difficult time. These are the only decisions that will help you become a more disciplined trader. So, always plan for the worst-case scenario and prepare to face it. You can only make better decisions when trading with money you can afford to lose.

It will avoid any panic situation when there is an unexpected movement or when things goes against your favor.

2. Never risk all of your trading capital at one trade.

I have seen many people who put their entire capital in just one trade with the hope that this one trade can give them a huge profit. We should keep one thing in mind that "Higher return comes with high risk."

We are all trading with predictions, and predictions can only have two outcomes: correct or incorrect. As a result, every trade we make will result in a profit or a loss.

That is why we should diversify our capital across different trades, because if one trade is losing money, another trade can compensate. We can easily manage our risk with diversification, and if you can manage your risk, profit will follow.

3. Trade with a Proper trading plan.

You must have a proper trading plan if you want to make money with options trading. A proper trading plan includes all of your entry, exit, stop loss and trade management information. It will tell you when to enter and, more importantly, when to exit the market.

If you trade without a proper trading plan, you are essentially handing over your money to the market.

So, consider why you've come here. Have you come here to make money or to lose money? So, before you put your hard-earned money into the live market, make a trading plan.

So, my dear friend, these are the three money management rules you should follow to if you want to be a successful options trader. If you require assistance or mentoring in developing a solid trading plan that includes all trading rules, position sizing, and risk management rules, please click on the button below and check our Option Strategies - A Mentorship Program.

Weekly Nifty Analysis and Options Trading Strategies for November 02, 2023

After a good rally and making a new all-time high, we saw some profit booking on the higher levels in October month. This week was a bad week for those who are holding longs in the market.

We saw a sharp decline of around 3.68% in Nifty. Not even nifty, we saw huge selling in the whole market especially Midcaps and small caps.

Now what next?

If you look at the chart, you will find that at 18600 - 18800, there is a strong support zone. And this support zone is the last hope for bulls.

If Nifty manages to hold this zone, then we may see some more upside levels and I breakdown, which is more likely to happens as per chart, will drag Nifty into the grip of bears completely for the downside target of 18000.

On the upside, 19200 is acting as an immediate resistance level for the coming week. A breakout will trigger a long trade and we can initiate a long position.

For a medium to long-term prospect, Nifty is still in an Uptrend. For a short-term or weekly perspective, we need a sustainable breakout or breakdown for further upside or downside levels. As per the current chart, the Weekly range can be 18500 – 19500.

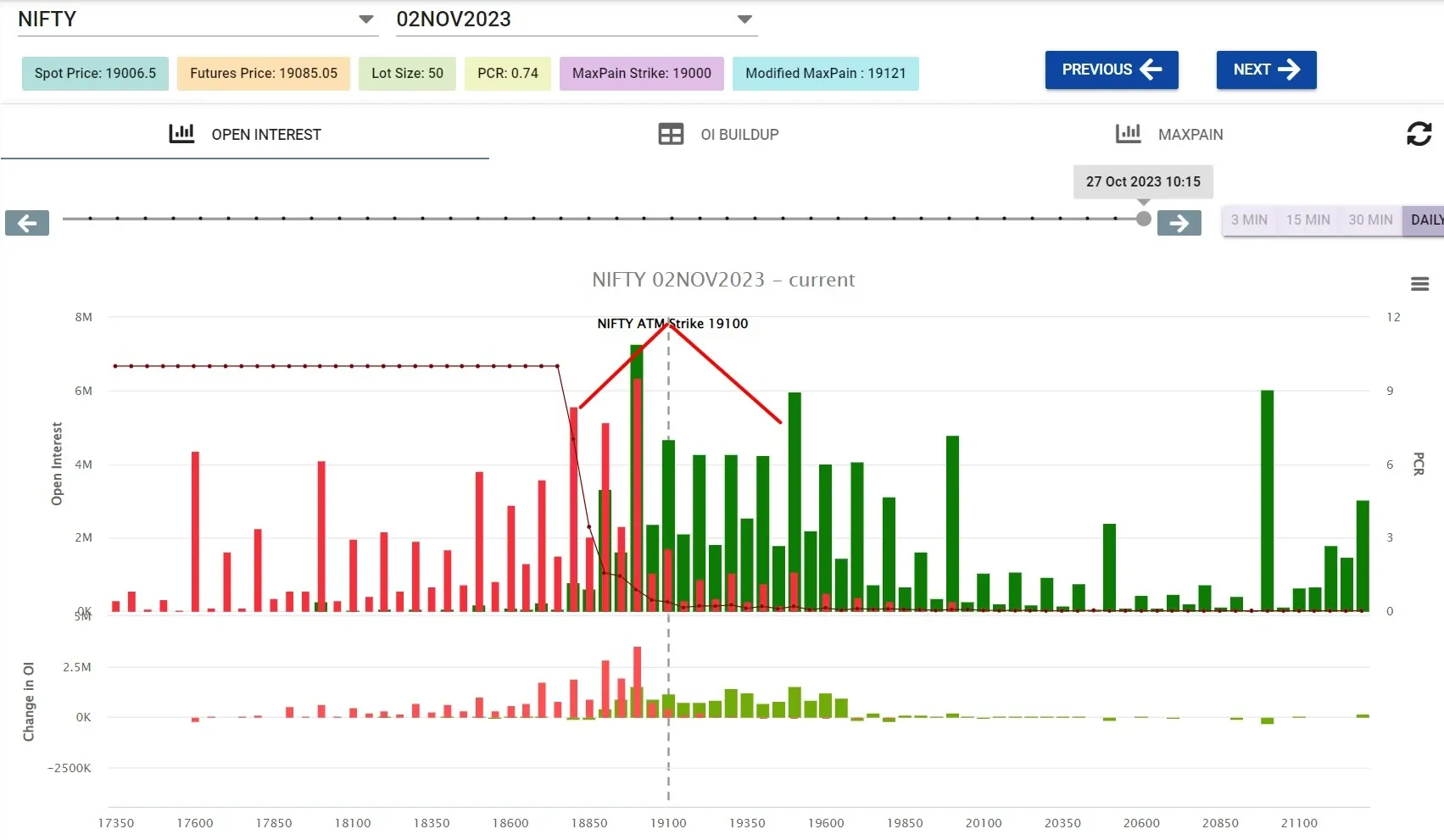

Nifty weekly option chain analysis

Based on option chain data, the highest Open interest stands at 19000 CE & PE, followed by 18800 CE & 19500 PE. PCR of all strikes is 0.74, which indicates a neutral market. PCR at 18800 stands at 7.29, which is acting as an immediate support level.

The Put-call ratio at 19500 stands at 0.18, which is acting as a resistance level. Equally, important indicator Option Pain is at 19000, indicating weekly expiry at 19000. A shift in option pain will provide further levels of expiry. So keep tracking max pain.

Keep tracking change in open interest to analyze market participant’s behavior, so that you can adjust your position accordingly. If you don’t know how to analyze open interest to find the best Weekly nifty and bank nifty options strategies. Just enroll for our Option Strategies – A Mentorship Program.

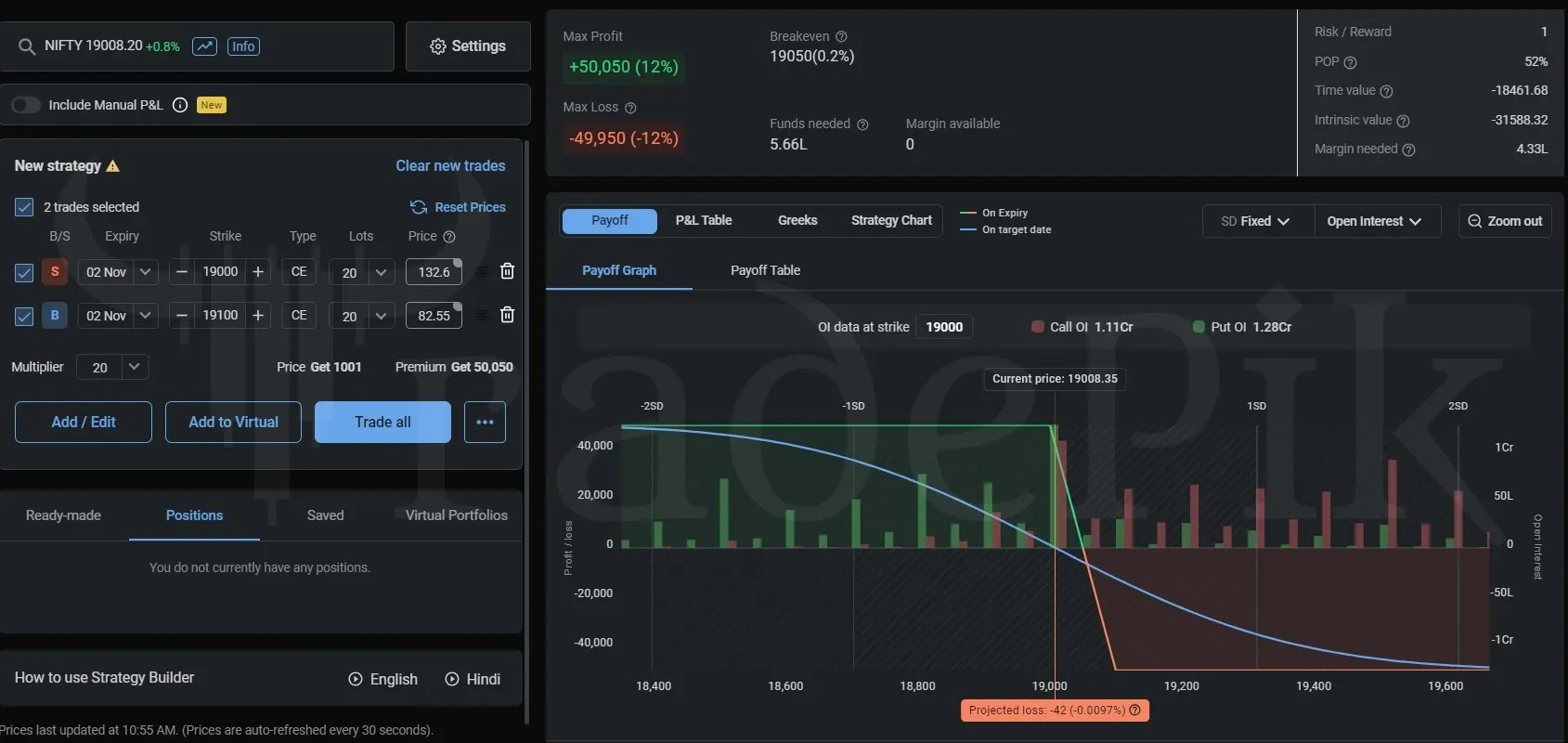

Weekly Nifty options trading Strategies: Bear Call Spread

Possible adjustments for Nifty options trading strategies:

Initially, you can keep a stop loss of 19200 for this strategy. Means square off if you find nifty is giving a breakout from 19200. Or you can do this adjustment too. ( Do not hold this strategy is loss is more than 2000₹).

If you find that Nifty is sustaining above 19100, you can add a Bull PUT spread at 19000 and convert it in to an iron butterfly.

If you want to learn how to find the Weekly nifty options trading strategies with adjustments in more practical ways with live mentorship, You can enroll in our Option Strategies – A Mentorship Program.

Weekly Bank Nifty options trading strategies for 28th October Expiry

Same as Nifty, We have seen sharp decline in BankNifty also. As per the charts, BankNifty looks more bearish compare to Nifty.

If you look at the chart, you will find that Bank Nifty has formed a double top pattern and gave a breakdown from 43600 which was acting as support for the double-top pattern.

Now, 41800 is acting as the immediate support level. A Breakdown will trigger more downside levels till 40000.

On the upside, No long trade until Bank Nifty is trading below 44500.

So based on the chart, a range-bound approach or sell on rise will be the best way to deal with this market.

As per the current chart, 41800 - 43100 could be the range for the coming week.

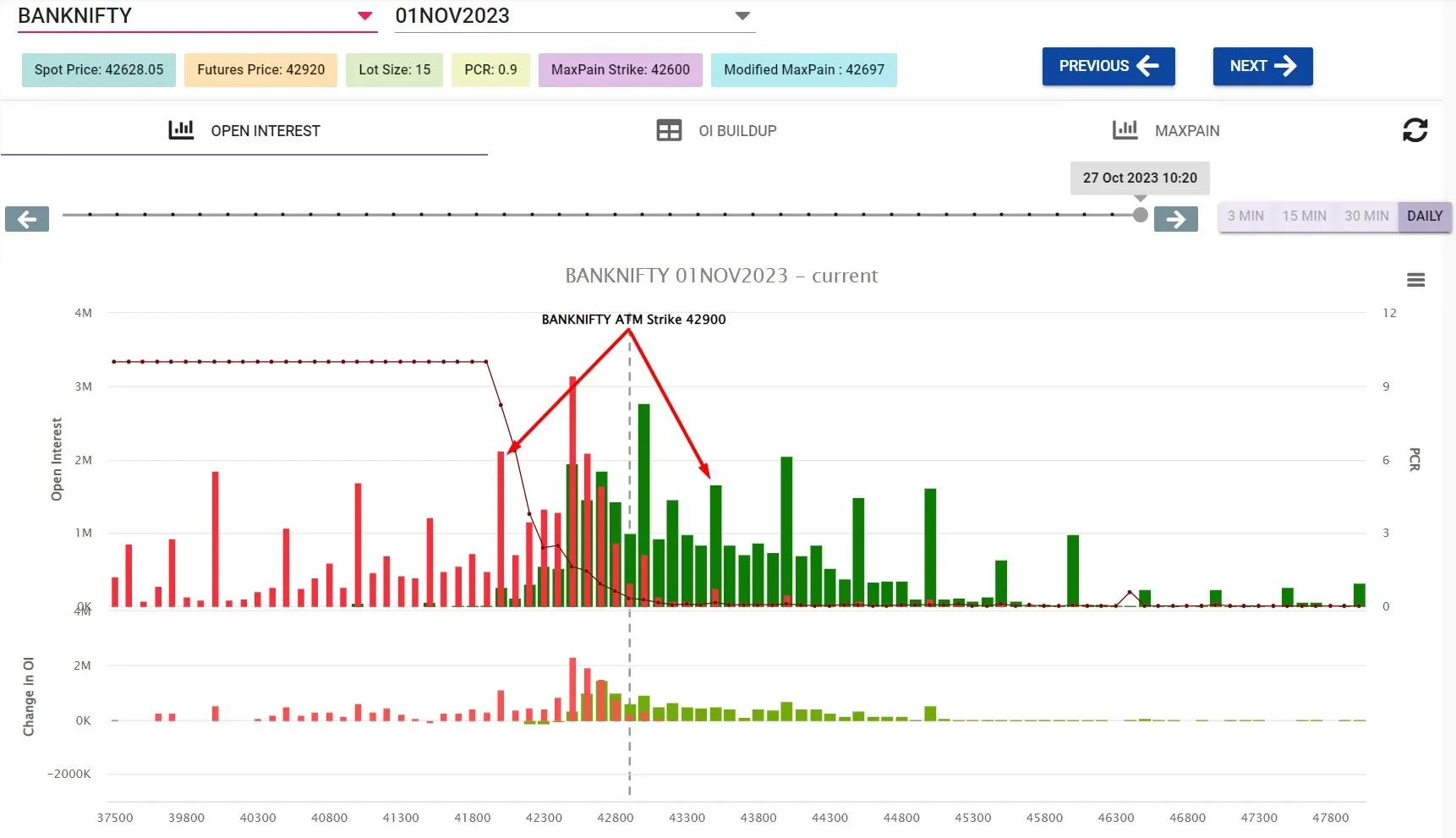

Weekly Bank Nifty options chain analysis

Based on Bank nifty option chain data, the highest Open interest stands at 43000 CE & 42500 PE, followed by 44000 CE & 42000 PE. PCR of all strikes is 0.9, which indicates a neutral market. PCR at 42000 stands at 8.25, which is acting as an immediate support level.

The Put-call ratio at 43500 stands at 0.13, which is acting as a resistance level. Equally, important indicator Option Pain is at 42600, indicating weekly expiry at 42600. A shift in option pain will provide further levels.

If you don’t know how to do the bank nifty options chain analysis to find your bank nifty options trading strategies, Just enroll for our Option Strategies – A Mentorship Program.

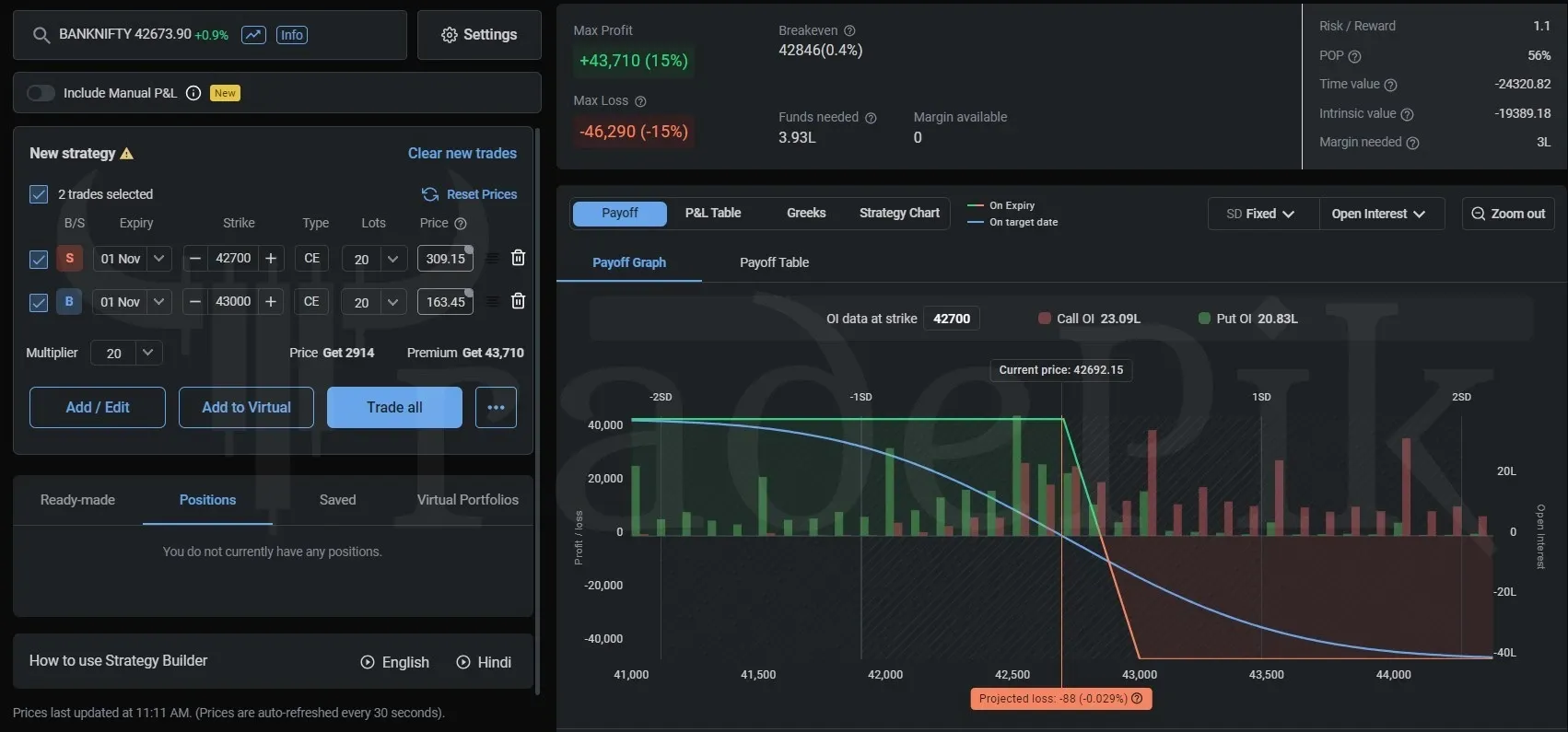

Bank Nifty option trading Strategies: Iron Condor

Possible adjustments for Bank nifty options trading strategies:

Possible adjustments for this best Bank Nifty option Strategies are:

- Follow a stop-loss if the max loss is above 2000₹ (1 lot), close this strategy.

- If you find that Bank Nifty is sustaining above 43000, then add a Bull Put Spread at 42700 and convert it into Iron Butterfly.

If you want to learn these bank nifty option strategies with adjustments in more practical ways with live mentorship, You can enroll in our Option Strategies – A Mentorship Program.

Post your comments in the comment box if you have a query related to the weekly analysis and Best Nifty and Bank Nifty options trading strategies. You can ask any question related to option trading in the comment box.

If you need More real-time assistance on how to find the Nifty and Bank nifty options trading strategies, Can take our premium subscription or open a trading account with us and you will get real-time assistance every month on the weekly analysis with Nifty and bank nifty options trading strategies. You can contact us on WhatsApp

*( Please avoid any questions like which Call or Put we should buy in the coming week).

Best Bank Nifty Option Buying Strategy

Discover a high-impact BankNifty Options Buying Strategy for intraday trading. Elevate your trading game with TradePik's expert insights and backtested data. Join the ranks of successful Indian options traders.

Options Strategies – A Mentorship Program

If you’re an options trader looking to take your skills to the next level, then our Options Strategies: A Mentorship Program is the perfect opportunity for you. With our program, you’ll learn advanced option hedging strategies and adjustments through live market support, giving you the hands-on experience you need to succeed.

By signing up for our program, you’ll gain access to a team of experienced options traders who will guide you every step of the way. You’ll learn how to identify the right options strategies for different market conditions, how to manage risk effectively, and how to adjust your positions as needed.

Plus, with our live market support, you’ll have the opportunity to ask questions and get real-time feedback on your trades. This personalized support will help you develop the confidence and skills you need to take on even the most challenging market conditions.

Don’t miss out on this valuable opportunity to take your options trading to the next level. Sign up for our Options Strategies: A Mentorship Program today and start your journey toward success!

DISCLAIMER: – we are not a SEBI research analyst. Views or the weekly analysis with nifty and bank nifty options trading strategies posted here only for educational purposes. There is no liability whatsoever for any loss arising from the use of this product or its contents. This product is not a recommendation to buy or sell, but rather a guideline to interpreting specified analysis methods. This information should only be used by investors and traders who are aware of the risk inherent in securities trading.